what do we call a loan to buy a house?

A mortgage loan or just mortgage () is a loan used either by purchasers of real property to raise funds to buy real manor, or past existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured holding ("foreclosure" or "repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide past its terms. The word mortgage is derived from a Law French term used in Britain in the Centre Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure.[ane] A mortgage tin can also exist described as "a borrower giving consideration in the course of a collateral for a do good (loan)".

Mortgage borrowers can be individuals mortgaging their home or they tin be businesses mortgaging commercial property (for instance, their own business premises, residential property let to tenants, or an investment portfolio). The lender volition typically exist a financial establishment, such as a banking concern, credit union or building society, depending on the country concerned, and the loan arrangements tin can be made either direct or indirectly through intermediaries. Features of mortgage loans such equally the size of the loan, maturity of the loan, interest rate, method of paying off the loan, and other characteristics can vary considerably. The lender's rights over the secured property take priority over the borrower's other creditors, which means that if the borrower becomes bankrupt or insolvent, the other creditors will only be repaid the debts owed to them from a sale of the secured property if the mortgage lender is repaid in full get-go.

In many jurisdictions, it is normal for home purchases to exist funded by a mortgage loan. Few individuals have enough savings or liquid funds to enable them to purchase property outright. In countries where the need for home buying is highest, strong domestic markets for mortgages have developed. Mortgages can either be funded through the banking sector (that is, through short-term deposits) or through the capital markets through a procedure called "securitization", which converts pools of mortgages into fungible bonds that can exist sold to investors in modest denominations.

Mortgage Loan. Total Payment (3 Fixed Involvement Rates & 2 Loan Term) = Loan Principal + Expenses (Taxes & fees) + Full interest to be paid.

The final toll will be exactly the same:

* when the interest rate is 2.5% and the term is 30 years than when the interest rate is 5% and the term is 15 years * when the interest rate is five% and the term is 30 years than when the interest rate is ten% and the term is 15 years

Mortgage loan basics

Basic concepts and legal regulation

According to Anglo-American property law, a mortgage occurs when an owner (usually of a fee simple interest in realty) pledges his or her interest (right to the property) as security or collateral for a loan. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but because nigh mortgages occur as a condition for new loan coin, the word mortgage has become the generic term for a loan secured by such real property. As with other types of loans, mortgages have an interest rate and are scheduled to amortize over a set period of time, typically 30 years. All types of real holding tin be, and usually are, secured with a mortgage and bear an involvement rate that is supposed to reverberate the lender'south run a risk.

Mortgage lending is the primary mechanism used in many countries to finance private buying of residential and commercial property (see commercial mortgages). Although the terminology and precise forms volition differ from country to land, the basic components tend to be like:

- Property: the physical residence existence financed. The exact form of buying volition vary from land to country and may restrict the types of lending that are possible.

- Mortgage: the security interest of the lender in the belongings, which may entail restrictions on the use or disposal of the property. Restrictions may include requirements to buy domicile insurance and mortgage insurance, or pay off outstanding debt before selling the property.

- Borrower: the person borrowing who either has or is creating an ownership interest in the property.

- Lender: whatever lender, but usually a banking company or other financial institution. (In some countries, specially the United states of america, Lenders may also be investors who ain an interest in the mortgage through a mortgage-backed security. In such a situation, the initial lender is known as the mortgage originator, which then packages and sells the loan to investors. The payments from the borrower are thereafter collected by a loan servicer.[two])

- Principal: the original size of the loan, which may or may not include certain other costs; as whatsoever chief is repaid, the principal will go downwardly in size.

- Involvement: a financial charge for employ of the lender's money.

- Foreclosure or repossession: the possibility that the lender has to preclude, repossess or seize the property under certain circumstances is essential to a mortgage loan; without this aspect, the loan is arguably no different from any other type of loan.

- Completion: legal completion of the mortgage act, and hence the beginning of the mortgage.

- Redemption: terminal repayment of the amount outstanding, which may be a "natural redemption" at the terminate of the scheduled term or a lump sum redemption, typically when the borrower decides to sell the property. A closed mortgage account is said to be "redeemed".

Many other specific characteristics are common to many markets, just the above are the essential features. Governments ordinarily regulate many aspects of mortgage lending, either directly (through legal requirements, for case) or indirectly (through regulation of the participants or the fiscal markets, such as the banking industry), and often through state intervention (direct lending by the government, straight lending by state-owned banks, or sponsorship of diverse entities). Other aspects that ascertain a specific mortgage marketplace may exist regional, historical, or driven by specific characteristics of the legal or financial system.

Mortgage loans are mostly structured every bit long-term loans, the periodic payments for which are like to an annuity and calculated according to the fourth dimension value of money formulae. The most bones arrangement would crave a fixed monthly payment over a period of ten to thirty years, depending on local weather condition. Over this menstruation the principal component of the loan (the original loan) would be slowly paid downwardly through acquittal. In practice, many variants are possible and common worldwide and inside each country.

Lenders provide funds against property to earn involvement income, and generally borrow these funds themselves (for example, past taking deposits or issuing bonds). The price at which the lenders borrow money, therefore, affects the price of borrowing. Lenders may as well, in many countries, sell the mortgage loan to other parties who are interested in receiving the stream of cash payments from the borrower, frequently in the form of a security (past means of a securitization).

Mortgage lending volition also take into account the (perceived) riskiness of the mortgage loan, that is, the likelihood that the funds will be repaid (usually considered a function of the creditworthiness of the borrower); that if they are not repaid, the lender volition be able to foreclose on the existent estate assets; and the financial, involvement charge per unit chance and time delays that may be involved in certain circumstances.

Mortgage underwriting

During the mortgage loan approval procedure, a mortgage loan underwriter verifies the fiscal data that the bidder has provided as to income, employment, credit history and the value of the abode beingness purchased via an appraisal.[three] An appraisal may be ordered. The underwriting process may take a few days to a few weeks. Sometimes the underwriting process takes so long that the provided fiscal statements need to be resubmitted so they are current.[4] It is advisable to maintain the same employment and non to use or open new credit during the underwriting procedure. Any changes fabricated in the bidder'southward credit, employment, or financial information could consequence in the loan being denied.

Mortgage loan types

At that place are many types of mortgages used worldwide, but several factors broadly define the characteristics of the mortgage. All of these may be discipline to local regulation and legal requirements.

- Interest: Involvement may be fixed for the life of the loan or variable, and change at certain pre-defined periods; the involvement charge per unit can likewise, of course, be college or lower.

- Term: Mortgage loans generally accept a maximum term, that is, the number of years after which an amortizing loan will be repaid. Some mortgage loans may accept no acquittal, or crave total repayment of whatsoever remaining residuum at a certain date, or even negative amortization.

- Payment amount and frequency: The corporeality paid per menstruum and the frequency of payments; in some cases, the amount paid per menstruum may change or the borrower may have the selection to increment or decrease the corporeality paid.

- Prepayment: Some types of mortgages may limit or restrict prepayment of all or a portion of the loan, or require payment of a penalty to the lender for prepayment.

The two basic types of amortized loans are the fixed rate mortgage (FRM) and adjustable-rate mortgage (ARM) (besides known equally a floating rate or variable rate mortgage). In some countries, such equally the United States, fixed charge per unit mortgages are the norm, only floating rate mortgages are relatively common. Combinations of fixed and floating rate mortgages are also mutual, whereby a mortgage loan volition have a fixed rate for some flow, for example the first 5 years, and vary after the cease of that menstruation.

- In a fixed-charge per unit mortgage, the interest rate, remains fixed for the life (or term) of the loan. In the example of an annuity repayment scheme, the periodic payment remains the aforementioned amount throughout the loan. In the case of linear payback, the periodic payment will gradually decrease.

- In an adjustable-rate mortgage, the interest rate is more often than not fixed for a catamenia of fourth dimension, after which information technology volition periodically (for instance, annually or monthly) adjust up or down to some market index. Adjustable rates transfer function of the interest rate adventure from the lender to the borrower and thus are widely used where fixed rate funding is difficult to obtain or prohibitively expensive. Since the risk is transferred to the borrower, the initial interest rate may be, for example, 0.5% to ii% lower than the average 30-yr fixed rate; the size of the toll differential volition be related to debt market place conditions, including the yield bend.

The charge to the borrower depends upon the credit hazard in addition to the involvement charge per unit risk. The mortgage origination and underwriting procedure involves checking credit scores, debt-to-income, downpayments, assets, and assessing belongings value. Colossal mortgages and subprime lending are not supported by authorities guarantees and face higher interest rates. Other innovations described beneath can affect the rates besides.

Loan to value and downward payments

Upon making a mortgage loan for the purchase of a property, lenders usually crave that the borrower brand a down payment; that is, contribute a portion of the cost of the property. This down payment may be expressed as a portion of the value of the belongings (meet below for a definition of this term). The loan to value ratio (or LTV) is the size of the loan against the value of the property. Therefore, a mortgage loan in which the purchaser has made a down payment of 20% has a loan to value ratio of 80%. For loans made confronting properties that the borrower already owns, the loan to value ratio will be imputed confronting the estimated value of the property.

The loan to value ratio is considered an important indicator of the riskiness of a mortgage loan: the college the LTV, the higher the gamble that the value of the property (in case of foreclosure) will be insufficient to cover the remaining principal of the loan.

Value: appraised, estimated, and actual

Since the value of the belongings is an important factor in understanding the take chances of the loan, determining the value is a key factor in mortgage lending. The value may be determined in various ways, but the most common are:

- Bodily or transaction value: this is usually taken to exist the buy cost of the belongings. If the property is not being purchased at the time of borrowing, this information may not be available.

- Appraised or surveyed value: in most jurisdictions, some form of appraisal of the value by a licensed professional is common. There is ofttimes a requirement for the lender to obtain an official appraisal.

- Estimated value: lenders or other parties may use their own internal estimates, particularly in jurisdictions where no official appraisement process exists, but also in some other circumstances.

Payment and debt ratios

In about countries, a number of more or less standard measures of creditworthiness may be used. Mutual measures include payment to income (mortgage payments as a percentage of gross or net income); debt to income (all debt payments, including mortgage payments, as a percentage of income); and various net worth measures. In many countries, credit scores are used in lieu of or to supplement these measures. In that location volition also be requirements for documentation of the creditworthiness, such as income taxation returns, pay stubs, etc. the specifics will vary from location to location. Income revenue enhancement incentives unremarkably tin can exist applied in forms of tax refunds or taxation deduction schemes. The outset implies that income tax paid by individual taxpayers will be refunded to the extent of involvement on mortgage loans taken to larn residential holding. Income revenue enhancement deduction implies lowering tax liability to the extent of involvement rate paid for the mortgage loan.

Some lenders may likewise require a potential borrower have one or more months of "reserve assets" available. In other words, the borrower may be required to bear witness the availability of enough assets to pay for the housing costs (including mortgage, taxes, etc.) for a period of time in the result of the chore loss or other loss of income.

Many countries take lower requirements for sure borrowers, or "no-doctor" / "depression-doc" lending standards that may be acceptable nether certain circumstances.

Standard or conforming mortgages

Many countries have a notion of standard or conforming mortgages that define a perceived acceptable level of risk, which may exist formal or informal, and may be reinforced by laws, regime intervention, or market practice. For example, a standard mortgage may exist considered to exist one with no more than 70–80% LTV and no more than than one-3rd of gross income going to mortgage debt.

A standard or befitting mortgage is a fundamental concept equally it frequently defines whether or not the mortgage can be hands sold or securitized, or, if not-standard, may affect the price at which it may be sold. In the United States, a befitting mortgage is 1 which meets the established rules and procedures of the 2 major government-sponsored entities in the housing finance marketplace (including some legal requirements). In contrast, lenders who decide to brand nonconforming loans are exercising a higher risk tolerance and practice so knowing that they confront more than challenge in reselling the loan. Many countries have like concepts or agencies that define what are "standard" mortgages. Regulated lenders (such as banks) may be subject to limits or college-gamble weightings for non-standard mortgages. For instance, banks and mortgage brokerages in Canada confront restrictions on lending more than eighty% of the holding value; beyond this level, mortgage insurance is generally required.[five]

Strange currency mortgage

In some countries with currencies that tend to depreciate, strange currency mortgages are common, enabling lenders to lend in a stable foreign currency, whilst the borrower takes on the currency chance that the currency will depreciate and they will therefore need to convert college amounts of the domestic currency to repay the loan.

Repaying the mortgage

Mortgage Loan. Full Payment = Loan Principal + Expenses (Taxes & fees) + Total interests. Stock-still Interest Rates & Loan Term

In addition to the ii standard means of setting the cost of a mortgage loan (fixed at a set interest rate for the term, or variable relative to marketplace interest rates), there are variations in how that cost is paid, and how the loan itself is repaid. Repayment depends on locality, tax laws and prevailing culture. There are also various mortgage repayment structures to suit different types of borrower.

Principal and interest

The nigh common way to repay a secured mortgage loan is to make regular payments toward the master and interest over a set term.[ citation needed ] This is normally referred to as (self) amortization in the U.South. and as a repayment mortgage in the Britain. A mortgage is a form of annuity (from the perspective of the lender), and the calculation of the periodic payments is based on the fourth dimension value of money formulas. Sure details may be specific to different locations: interest may exist calculated on the basis of a 360-day year, for example; interest may exist compounded daily, yearly, or semi-annually; prepayment penalties may apply; and other factors. At that place may be legal restrictions on certain matters, and consumer protection laws may specify or prohibit certain practices.

Depending on the size of the loan and the prevailing exercise in the country the term may be brusk (10 years) or long (50 years plus). In the United kingdom and U.S., 25 to thirty years is the usual maximum term (although shorter periods, such as 15-twelvemonth mortgage loans, are common). Mortgage payments, which are typically made monthly, incorporate a repayment of the principal and an interest element. The corporeality going toward the principal in each payment varies throughout the term of the mortgage. In the early years the repayments are generally involvement. Towards the cease of the mortgage, payments are mostly for principal. In this style, the payment corporeality adamant at showtime is calculated to ensure the loan is repaid at a specified engagement in the futurity. This gives borrowers balls that by maintaining repayment the loan will be cleared at a specified engagement if the interest rate does not change. Some lenders and third parties offer a bi-weekly mortgage payment program designed to accelerate the payoff of the loan. Similarly, a mortgage can be concluded before its scheduled end past paying some or all of the remainder prematurely, called curtailment.[6]

An amortization schedule is typically worked out taking the principal left at the end of each month, multiplying past the monthly charge per unit and and then subtracting the monthly payment. This is typically generated by an amortization reckoner using the post-obit formula:

where:

- is the periodic amortization payment

- is the chief amount borrowed

- is the rate of interest expressed as a fraction; for a monthly payment, take the (Almanac Rate)/12

- is the number of payments; for monthly payments over 30 years, 12 months x 30 years = 360 payments.

Interest only

The main alternative to a primary and interest mortgage is an interest-only mortgage, where the master is not repaid throughout the term. This type of mortgage is common in the UK, specially when associated with a regular investment plan. With this organization regular contributions are fabricated to a split investment program designed to build upwardly a lump sum to repay the mortgage at maturity. This type of organization is called an investment-backed mortgage or is often related to the blazon of programme used: endowment mortgage if an endowment policy is used, similarly a personal equity programme (PEP) mortgage, Individual Savings Account (ISA) mortgage or alimony mortgage. Historically, investment-backed mortgages offered diverse tax advantages over repayment mortgages, although this is no longer the case in the UK. Investment-backed mortgages are seen as higher adventure as they are dependent on the investment making sufficient return to clear the debt.

Until recently[ when? ] it was not uncommon for interest only mortgages to be bundled without a repayment vehicle, with the borrower gambling that the property market will rise sufficiently for the loan to be repaid by trading down at retirement (or when rent on the belongings and aggrandizement combine to surpass the interest rate)[ commendation needed ].

Interest-only lifetime mortgage

Recent Financial Services Authority guidelines to Great britain lenders regarding interest-only mortgages has tightened the criteria on new lending on an interest-only ground. The trouble for many people has been the fact that no repayment vehicle had been implemented, or the vehicle itself (e.thou. endowment/ISA policy) performed poorly and therefore insufficient funds were available to repay residue at the cease of the term.

Moving forward, the FSA under the Mortgage Market Review (MMR) have stated in that location must be strict criteria on the repayment vehicle being used. As such the likes of Nationwide and other lenders have pulled out of the interest-just market place.

A resurgence in the equity release market has been the introduction of interest-only lifetime mortgages. Where an interest-only mortgage has a fixed term, an interest-merely lifetime mortgage will continue for the rest of the mortgagors life. These schemes have proved of involvement to people who do like the roll-up consequence (compounding) of interest on traditional equity release schemes. They have also proved beneficial to people who had an involvement-only mortgage with no repayment vehicle and now demand to settle the loan. These people tin can now effectively remortgage onto an interest-only lifetime mortgage to maintain continuity.

Interest-just lifetime mortgage schemes are currently offered by two lenders – Stonehaven and more2life. They work by having the options of paying the interest on a monthly basis. Past paying off the involvement means the residuum will remain level for the residual of their life. This market is set to increase as more than retirees require finance in retirement.

Reverse mortgages

For older borrowers (typically in retirement), it may be possible to accommodate a mortgage where neither the principal nor involvement is repaid. The interest is rolled upward with the primary, increasing the debt each year.

These arrangements are variously chosen contrary mortgages, lifetime mortgages or equity release mortgages (referring to home equity), depending on the country. The loans are typically not repaid until the borrowers are deceased, hence the age brake.

Through the Federal Housing Administration, the U.S. regime insures opposite mortgages via a program called the HECM (Home Equity Conversion Mortgage). Different standard mortgages (where the unabridged loan amount is typically disbursed at the time of loan endmost) the HECM program allows the homeowner to receive funds in a variety of ways: as a one time lump sum payment; as a monthly tenure payment which continues until the borrower dies or moves out of the house permanently; equally a monthly payment over a defined period of time; or as a credit line.[7]

For farther details, see equity release.

Interest and partial principal

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated (amortized) over a certain term, but the outstanding balance on the principal is due at some point curt of that term. In the Great britain, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed.

Variations

Graduated payment mortgage loans take increasing costs over fourth dimension and are geared to young borrowers who expect wage increases over time. Balloon payment mortgages have only fractional amortization, significant that amount of monthly payments due are calculated (amortized) over a certain term, but the outstanding principal residual is due at some signal short of that term, and at the cease of the term a balloon payment is due. When interest rates are high relative to the rate on an existing seller's loan, the buyer can consider assuming the seller'southward mortgage.[8] A wraparound mortgage is a form of seller financing that can brand information technology easier for a seller to sell a belongings. A biweekly mortgage has payments made every two weeks instead of monthly.

Upkeep loans include taxes and insurance in the mortgage payment;[9] packet loans add the costs of furnishings and other personal property to the mortgage. Buydown mortgages allow the seller or lender to pay something like to points to reduce interest charge per unit and encourage buyers.[10] Homeowners tin can besides take out equity loans in which they receive cash for a mortgage debt on their firm. Shared appreciation mortgages are a class of equity release. In the The states, strange nationals due to their unique state of affairs face Foreign National mortgage atmospheric condition.

Flexible mortgages allow for more liberty by the borrower to skip payments or prepay. Offset mortgages let deposits to be counted confronting the mortgage loan. In the UK there is also the endowment mortgage where the borrowers pay interest while the chief is paid with a life insurance policy.

Commercial mortgages typically accept different interest rates, risks, and contracts than personal loans. Participation mortgages let multiple investors to share in a loan. Builders may accept out blanket loans which cover several properties at once. Bridge loans may be used as temporary financing awaiting a longer-term loan. Hard money loans provide financing in commutation for the mortgaging of existent manor collateral.

Foreclosure and non-recourse lending

In nigh jurisdictions, a lender may foreclose the mortgaged belongings if certain conditions occur – principally, non-payment of the mortgage loan. Subject to local legal requirements, the belongings may then be sold. Any amounts received from the sale (net of costs) are applied to the original debt. In some jurisdictions, mortgage loans are non-recourse loans: if the funds recouped from sale of the mortgaged property are insufficient to cover the outstanding debt, the lender may non have recourse to the borrower after foreclosure. In other jurisdictions, the borrower remains responsible for any remaining debt.

In virtually all jurisdictions, specific procedures for foreclosure and sale of the mortgaged holding utilize, and may be tightly regulated by the relevant government. In that location are strict or judicial foreclosures and non-judicial foreclosures, too known equally power of auction foreclosures. In some jurisdictions, foreclosure and sale can occur quite rapidly, while in others, foreclosure may accept many months or even years. In many countries, the power of lenders to forestall is extremely limited, and mortgage market development has been notably slower.

National differences

A report issued by the Un Economic Commission for Europe compared German language, United states of america, and Danish mortgage systems. The German Bausparkassen have reported nominal interest rates of approximately 6 per cent per annum in the final 40 years (as of 2004). German Bausparkassen (savings and loans associations) are not identical with banks that give mortgages. In improver, they charge administration and service fees (well-nigh ane.five per cent of the loan corporeality). Notwithstanding, in the United States, the boilerplate interest rates for stock-still-charge per unit mortgages in the housing market started in the tens and twenties in the 1980s and have (equally of 2004) reached about 6 per cent per annum. However, gross borrowing costs are substantially higher than the nominal involvement rate and amounted for the last 30 years to 10.46 per cent. In Kingdom of denmark, like to the United states mortgage market, interest rates take fallen to six per cent per annum. A risk and assistants fee amounts to 0.5 per cent of the outstanding debt. In addition, an acquisition fee is charged which amounts to i per cent of the main.[11]

United States

The mortgage industry of the United States is a major financial sector. The federal regime created several programs, or government sponsored entities, to foster mortgage lending, construction and encourage domicile ownership. These programs include the Government National Mortgage Association (known as Ginnie Mae), the Federal National Mortgage Association (known as Fannie Mae) and the Federal Home Loan Mortgage Corporation (known as Freddie Mac).

The U.s.a. mortgage sector has been the center of major financial crises over the last century. Unsound lending practices resulted in the National Mortgage Crisis of the 1930s, the savings and loan crisis of the 1980s and 1990s and the subprime mortgage crisis of 2007 which led to the 2010 foreclosure crisis.

In the United states of america, the mortgage loan involves two split up documents: the mortgage note (a promissory note) and the security involvement evidenced by the "mortgage" document; generally, the two are assigned together, simply if they are split traditionally the holder of the note and not the mortgage has the right to foreclose.[12] For example, Fannie Mae promulgates a standard class contract Multistate Fixed-Rate Note 3200[thirteen] and too separate security musical instrument mortgage forms which vary by state.[14]

History in the The states

The thought of purchasing land is a relatively new idea. The idea of credit existence used to purchase land originated with the British colonies in the future United States. The colonists did not give ethnic people already living in America any money for the land they took from them. This was not the just shocking difference between pre-colonized America and post-colonized America. There were huge environmental and biological changes, which led to social, economic, and political changes. There was new types of violence and diseases brought to America. The colonists traded with "wampum,"[15] which was a string of beat out beads in dissimilar colors and shells. White ones were called wompi, blackness ones were called sucka uhock. Circular clams were worth twice as much equally the white wompi shells. They were effectually one-8th of an inch in diameter and one-quarter inch in length. Colonists attempted to merchandise with indigenous people for skins by growing corn. But corn could not get the colonists the best skins, such every bit beaver skins. The shells were chosen to exist used as money because of the symbolic meaning they held for the tribes. Indigenous people believed the shells came from a type of God.[xv] The shells could even be talked into to go on words and stories. On the colonists' side, there was also a significance that the indigenous people did not empathise. Colonists from England actively pursued trade with the indigenous people, and adopted their ideas for trade. The English language originally were surprised to meet that people did not automatically follow the trading customs of England. As more and more colonists came to America, the indigenous people lost some of their power. They began to stockpile appurtenances that they knew the colonists would want to keep their ability in the trade. Equally colonists expanded into new spaces, the power dynamic got worse for the indigenous people.[fifteen] The colonists began to exploit the differences between the groups of how important certain goods were. They created debt around the thought of purchasing land. William Pynchon, a settler in what is currently Connecticut, used wampum to gain an reward in the fur merchandise. He gave out credit to settlers who helped him create wampum. Later on a while of the settlers being in the The states, land became its ain kind of money. This assisted the colonists in taking the land from the indigenous people.[15]

Canada

In Canada, the Canada Mortgage and Housing Corporation (CMHC) is the state's national housing agency, providing mortgage loan insurance, mortgage-backed securities, housing policy and programs, and housing research to Canadians.[xvi] It was created by the federal government in 1946 to accost the country'southward post-war housing shortage, and to help Canadians attain their homeownership goals.

The almost common mortgage in Canada is the five-year fixed-rate closed mortgage, equally opposed to the U.S. where the most common type is the 30-twelvemonth fixed-rate open mortgage.[17] Throughout the financial crisis and the ensuing recession, Canada's mortgage market connected to function well, partly due to the residential mortgage marketplace'south policy framework, which includes an constructive regulatory and supervisory government that applies to well-nigh lenders. Since the crisis, however, the low involvement rate environment that has arisen has contributed to a meaning increase in mortgage debt in the country.[18]

In April 2014, the Office of the Superintendent of Financial Institutions (OSFI) released guidelines for mortgage insurance providers aimed at tightening standards effectually underwriting and risk management. In a argument, the OSFI has stated that the guideline will "provide clarity almost all-time practices in respect of residential mortgage insurance underwriting, which contribute to a stable fiscal organization." This comes afterwards several years of federal government scrutiny over the CMHC, with former Finance Minister Jim Flaherty musing publicly as far back as 2012 about privatizing the Crown corporation.[nineteen]

In an effort to cool downwardly the real estate prices in Canada, Ottawa introduced a mortgage stress test effective 17 Oct 2016.[20] Under the stress test, every domicile buyer who wants to go a mortgage from any federally regulated lender should undergo a exam in which the borrower'southward affordability is judged based on a charge per unit that is not lower than a stress rate set by the Bank of Canada. For loftier-ratio mortgage (loan to value of more than fourscore%), which is insured by Canada Mortgage and Housing Corporation, the rate is the maximum of the stress test rate and the current target rate. Yet, for uninsured mortgage, the rate is the maximum of the stress test charge per unit and the target interest rate plus 2%. [21] This stress test has lowered the maximum mortgage canonical amount for all borrowers in Canada.

The stress-test rate consistently increased until its acme of five.34% in May 2018 and it was non changed until July 2019 in which for the commencement time in three years it decreased to 5.19%.[22] This decision may reflect the push-back from the real-manor industry[23] as well equally the introduction of the first-fourth dimension home heir-apparent incentive program (FTHBI) past the Canadian government in the 2019 Canadian federal upkeep. Because of all the criticisms from real manor industry, Canada finance minister Bill Morneau ordered to review and consider changes to the mortgage stress test in December 2019.[24]

Uk

The mortgage industry of the United kingdom of great britain and northern ireland has traditionally been dominated by building societies, only from the 1970s the share of the new mortgage loans market held past building societies has declined substantially. Between 1977 and 1987, the share fell from 96% to 66% while that of banks and other institutions rose from 3% to 36%. At that place are currently over 200 significant separate financial organizations supplying mortgage loans to house buyers in Britain. The major lenders include building societies, banks, specialized mortgage corporations, insurance companies, and pension funds.

In the UK variable-rate mortgages are more than common than in the United States.[25] [26] This is in part because mortgage loan financing relies less on fixed income securitized avails (such as mortgage-backed securities) than in the United states of america, Denmark, and Germany, and more than on retail savings deposits like Australia and Spain.[25] [26] Thus, lenders prefer variable-rate mortgages to fixed rate ones and whole-of-term fixed charge per unit mortgages are mostly not bachelor. Nevertheless, in contempo years fixing the rate of the mortgage for short periods has become popular and the initial 2, iii, five and, occasionally, x years of a mortgage can be stock-still.[27] From 2007 to the beginning of 2013 between l% and 83% of new mortgages had initial periods fixed in this way.[28]

Home buying rates are comparable to the United States, merely overall default rates are lower.[25] Prepayment penalties during a fixed rate menstruum are common, whilst the Usa has discouraged their employ.[25] Like other European countries and the rest of the earth, simply different near of the United States, mortgages loans are usually not nonrecourse debt, meaning debtors are liable for whatever loan deficiencies after foreclosure.[25] [29]

The customer-facing aspects of the residential mortgage sector are regulated by the Financial Conduct Authority (FCA), and lenders' financial probity is overseen by a separate regulator, the Prudential Regulation Authority (PRA) which is part of the Bank of England. The FCA and PRA were established in 2013 with the aim of responding to criticism of regulatory failings highlighted past the financial crisis of 2007–2008 and its aftermath.[30] [31] [32]

Continental Europe

In virtually of Western Europe (except Denmark, kingdom of the netherlands and Germany), variable-rate mortgages are more common, unlike the fixed-rate mortgage common in the United States.[25] [26] Much of Europe has home ownership rates comparable to the United States, simply overall default rates are lower in Europe than in the United states.[25] Mortgage loan financing relies less on securitizing mortgages and more on formal regime guarantees backed by covered bonds (such as the Pfandbriefe) and deposits, except Denmark and Frg where asset-backed securities are also common.[25] [26] Prepayment penalties are nonetheless mutual, whilst the The states has discouraged their apply.[25] Unlike much of the United States, mortgage loans are usually non nonrecourse debt.[25]

Within the Eu, covered bonds market volume (covered bonds outstanding) amounted to about EUR two trillion at yr-finish 2007 with Germany, Denmark, Spain, and French republic each having outstandings higher up 200,000 EUR one thousand thousand.[33] Pfandbrief-like securities accept been introduced in more than than 25 European countries—and in recent years also in the U.South. and other countries exterior Europe—each with their own unique police force and regulations.[34]

Contempo trends

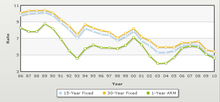

Mortgage rates historical trends 1986 to 2010

On July 28, 2008, The states Treasury Secretary Henry Paulson announced that, forth with four large U.S. banks, the Treasury would attempt to boot start a market for these securities in the United States, primarily to provide an alternative class of mortgage-backed securities.[35] Similarly, in the UK "the Regime is inviting views on options for a UK framework to deliver more affordable long-term stock-still-rate mortgages, including the lessons to exist learned from international markets and institutions".[36]

George Soros's October 10, 2008 The Wall Street Journal editorial promoted the Danish mortgage market model.[37]

Malaysia

Mortgages in Malaysia tin be categorised into ii different groups: conventional home loan and Islamic home loan. Under the conventional home loan, banks normally charge a stock-still involvement rate, a variable involvement rate, or both. These interest rates are tied to a base of operations rate (individual depository financial institution'due south benchmark rate).

For Islamic home financing, it follows the Sharia Law and comes in 2 mutual types: Bai' Bithaman Ajil (BBA) or Musharakah Mutanaqisah (MM). Bai' Bithaman Ajil is when the bank buys the holding at current market price and sells information technology back to you at a much higher price. Musharakah Mutanaqisah is when the bank buys the holding together with yous. You volition so slowly purchase the depository financial institution'due south portion of the property through rental (whereby a portion of the rental goes to paying for the purchase of a part of the bank's share in the belongings until the property comes to your complete buying).

Islamic countries

Islamic Sharia law prohibits the payment or receipt of interest, significant that Muslims cannot use conventional mortgages. However, existent estate is far besides expensive for almost people to purchase outright using cash: Islamic mortgages solve this problem by having the property modify hands twice. In one variation, the bank will purchase the house outright and then act every bit a landlord. The homebuyer, in add-on to paying rent, volition pay a contribution towards the buy of the belongings. When the last payment is fabricated, the property changes hands.[ clarification needed ]

Typically, this may lead to a higher concluding price for the buyers. This is considering in some countries (such as the U.k. and India) in that location is a stamp duty which is a taxation charged by the regime on a change of ownership. Because ownership changes twice in an Islamic mortgage, a stamp tax may exist charged twice. Many other jurisdictions have similar transaction taxes on change of ownership which may be levied. In the United Kingdom, the dual awarding of postage stamp duty in such transactions was removed in the Finance Act 2003 in order to facilitate Islamic mortgages.[38]

An alternative scheme involves the bank reselling the property according to an installment program, at a toll higher than the original price.

Both of these methods compensate the lender equally if they were charging interest, simply the loans are structured in a way that in name they are not, and the lender shares the financial risks involved in the transaction with the homebuyer.[ citation needed ]

Mortgage insurance

Mortgage insurance is an insurance policy designed to protect the mortgagee (lender) from any default by the mortgagor (borrower). It is used commonly in loans with a loan-to-value ratio over 80%, and employed in the effect of foreclosure and repossession.

This policy is typically paid for past the borrower every bit a component to final nominal (note) charge per unit, or in one lump sum up front, or as a separate and itemized component of monthly mortgage payment. In the last case, mortgage insurance tin be dropped when the lender informs the borrower, or its subsequent assigns, that the property has appreciated, the loan has been paid down, or any combination of both to relegate the loan-to-value under 80%.

In the outcome of repossession, banks, investors, etc. must resort to selling the belongings to recoup their original investment (the money lent) and are able to dispose of hard assets (such as real manor) more quickly by reductions in cost. Therefore, the mortgage insurance acts every bit a hedge should the repossessing authorization recover less than full and off-white market value for whatsoever hard asset.

See as well

- Commercial mortgage

- Mortgage analytics

- No Income No Nugget (NINA)

- Nonrecourse debt

- Refinancing

- Second Mortgage

- Purchase to let

- Mortgage cashback

- Remortgage

- UK mortgage terminology

- Commercial lender (United states of america) – a term for a lender collateralizing non-residential properties.

- eMortgages

- FHA loan – Relating to the U.S. Federal Housing Administration

- Fixed rate mortgage calculations (Usa)

- Location Efficient Mortgage – a type of mortgage for urban areas

- Mortgage supposition

- pre-approval – U.Southward. mortgage terminology

- pre-qualification – U.S. mortgage terminology

- Predatory mortgage lending

- VA loan – Relating to the U.Southward. Department of Veterans Diplomacy.

Other nations

- Danish mortgage market

- Hypothec - equivalent in civil police countries

- Mortgage Investment Corporation

Legal details

- Human activity – legal aspects

- Mechanics lien – a legal concept

- Perfection – applicable legal filing requirements

References

- ^ Coke, Edward. Commentaries on the Laws of England.

[I]f he doth non pay, and then the Country which is put in pledge upon status for the payment of the money, is taken from him for e'er, and then dead to him upon status, &c. And if he doth pay the coin, and then the pledge is expressionless as to the Tenant

- ^ FTC. Mortgage Servicing: Making Sure Your Payments Count.

- ^ "How Long Does Mortgage Underwriting Have?". homeguides.sfgate.com. SFGate. Retrieved 9 Dec 2016.

- ^ "What Is an Underwriter: The Unseen Approver of Your Mortgage". 26 Feb 2014.

- ^ "Who Needs Mortgage Loan Insurance?". Canadian Mortgage and Housing Corporation. Retrieved 2009-01-30 .

- ^ Bodine, Alicia (April 5, 2019). "Definition of Mortgage Curtailment". budgeting.thenest.com. Certified Ramsey Solutions Master Financial Coach (Updated).

- ^ "How do HECM Reverse Mortgages Work?". The Mortgage Professor.

- ^ Are Mortgage Assumptions a Expert Bargain?. Mortgage Professor.

- ^ Cortesi GR. (2003). Mastering Real Manor Principals. p. 371

- ^ Homes: Tedious-market savings – the 'buy-down'. CNN Money.

- ^ http://www.unece.org/hlm/prgm/hmm/hsg_finance/publications/housing.finance.arrangement.pdf , p. 46

- ^ Renuart E. (2012). Holding Championship Problem in Not-Judicial Foreclosure States: The Ibanez Time Flop?. Albany Law School

- ^ Single-family unit notes. Fannie Mae.

- ^ Security Instruments. Fannie Mae.

- ^ a b c d Park, Sue (2016). "Coin, Mortgages, and the Conquest of America". Police & Social Inquiry. 41 (four): 1006–1035. doi:10.1111/lsi.12222. S2CID 157705999.

- ^ "About CMHC - CMHC". CMHC.

- ^ "Comparison Canada and U.Southward. Housing Finance Systems - CMHC". CMHC.

- ^ Crawford, Allan. "The Residential Mortgage Marketplace in Canada: A Primer" (PDF). bankofcanada.ca.

- ^ Greenwood, John (14 April 2014). "New mortgage guidelines push CMHC to embrace insurance basics". Financial Mail.

- ^ "New mortgage stress exam rules kicking in today". CBC News. Retrieved 18 March 2019.

- ^ "Mortgage Qualifier Tool". Government of Canada. 11 May 2012.

- ^ Evans, Pete (July 19, 2019). "Mortgage stress examination rules get more than lenient for first time". CBC News . Retrieved Oct xxx, 2019.

- ^ Zochodne, Geoff (June xi, 2019). "Regulator defends mortgage stress test in confront of button-back from industry". Financial Post . Retrieved October 30, 2019.

- ^ Zochodne, Geoff (13 Dec 2019). "Finance minister Bill Morneau to review and consider changes to mortgage stress test". Fiscal Post.

- ^ a b c d e f g h i j Congressional Budget Office (2010). Fannie Mae, Freddie Mac, and the Federal Role in the Secondary Mortgage Market. p. 49.

- ^ a b c d International monetary fund (2004). World Economical Outlook: September 2004: The Global Demographic Transition. pp. 81–83. ISBN978-ane-58906-406-5.

- ^ "Best fixed rate mortgages: ii, three, five and 10 years". The Telegraph. 26 February 2014. Archived from the original on 2022-01-11. Retrieved x May 2014.

- ^ "Demand for stock-still mortgages hits all-fourth dimension high". The Telegraph. 17 May 2013. Archived from the original on 2022-01-eleven. Retrieved x May 2014.

- ^ United Nations (2009). Forest Products Annual Market Review 2008-2009. United Nations Publications. p. 42. ISBN978-92-1-117007-eight.

- ^ Vina, Gonzalo. "U.Thou. Scraps FSA in Biggest Bank Regulation Overhaul Since 1997". Businessweek. Bloomberg L.P. Retrieved ten May 2014.

- ^ "Regulatory Reform Background". FSA web site. FSA. Retrieved 10 May 2014.

- ^ "Fiscal Services Beak receives Royal Assent". HM Treasury. 19 Dec 2012. Retrieved 10 May 2014.

- ^ "Covered Bail Outstanding 2007".

- ^ "UNECE Homepage" (PDF). www.unece.org.

- ^ owner, name of the document. "FDIC: Printing Releases - PR-lx-2008 seven/fifteen/2008". www.fdic.gov.

- ^ "Housing Finance Review: assay and proposals. HM Treasury, March 2008" (PDF).

- ^ Soros, George (10 October 2008). "Denmark Offers a Model Mortgage Market place". Wall Street Journal – via www.wsj.com.

- ^ "SDLTM28400 - Stamp Duty Land Taxation Manual - HMRC internal manual - GOV.United kingdom". www.hmrc.gov.united kingdom.

External links

- Mortgages at Curlie

- Mortgages: For Home Buyers and Homeowners at United states.gov

- Australian Securities & Investments Commission (ASIC) Dwelling Loans

Source: https://en.wikipedia.org/wiki/Mortgage_loan

0 Response to "what do we call a loan to buy a house?"

Post a Comment